It is important to review your paycheck periodically to verify your benefits deductions and university contributions. To view you paycheck online, log in to Wolverine Access. Select Employee Self-Service and then click View Paycheck under Payroll and Compensation.

Your paycheck displays your Basic Retirement Savings Plan contributions and the university contributions differently depending on a number of factors. The areas of interest to review for retirement savings contributions are the Before-Tax Deductions (your contributions) and the Employer Paid Benefits (university contributions) sections in the middle of your paycheck.

Examples are for Illustration Only

Please note that the examples shown are for illustration only, and are based on an individual who is eligible to contribute 5 percent to the Basic Retirement Savings Plan and becomes eligible to receive a 5 percent or 10 percent matching contribution from the university.

The examples show only the Basic Retirement Savings Plan deductions and contributions and no other benefit plans in which you may be enrolled. Refer to your own paycheck for specific information on your benefits deductions and university contributions.

Voluntary Enrollment in the Basic Plan

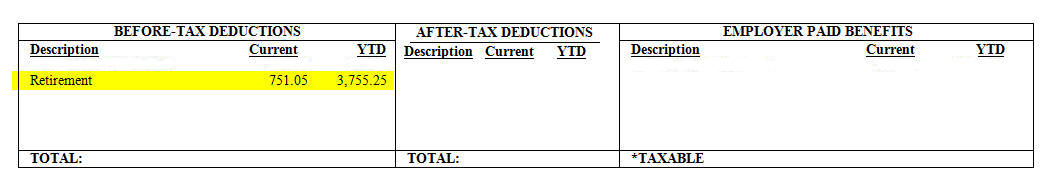

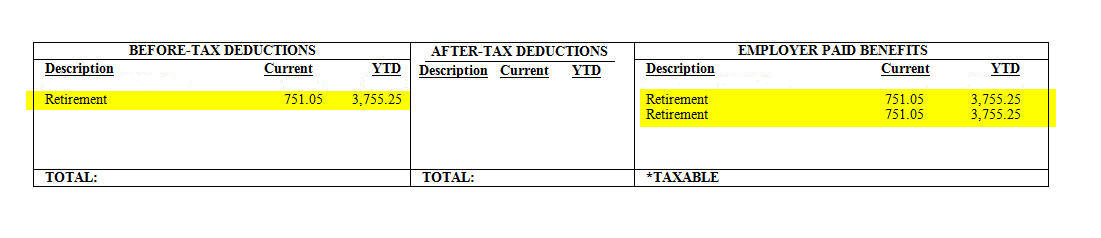

Enrolled with Less than One Year of Service

If you enroll in the Basic Retirement Savings Plan and have less than one year of eligible service:

- You contribute 5 percent

- No U-M contribution

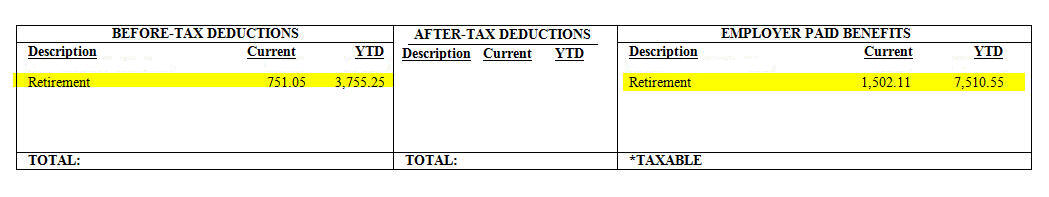

Enrolled with More than One Year of Service

If you are enrolled in the Basic Retirement Savings Plan and have over 12 months of eligible service (the waiting period to receive the two-for-one university match):

- You contribute 5 percent

- U-M contributes 10 percent

Compulsory Participation

Faculty or staff members may voluntarily join the Basic Retirement Plan at any time. However, participation becomes compulsory for regular staff members who:

- are age 35 or older,

- work a 100% appointment, and

- have at least two years of service in a title eligible for the Basic Retirement Plan.

If you are already a voluntary participant in the Basic Retirement Plan when you meet the above criteria, your contribution and the U-M contribution amounts remain the same. However, once you become compulsory your paycheck displays the U-M contributions differently.

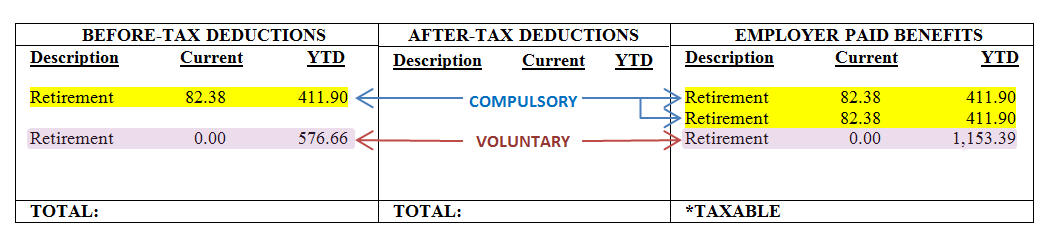

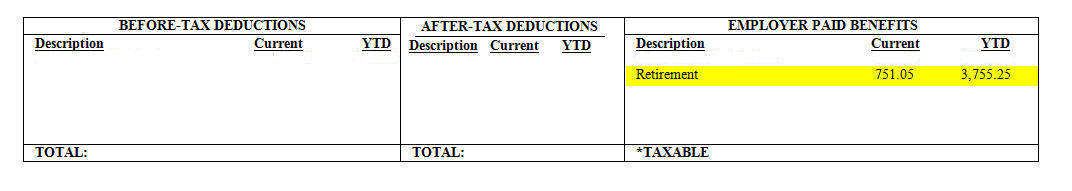

Transition from Voluntary to Compulsory

A paycheck for a voluntary participant who becomes compulsory during the course of a year will have multiple Retirement rows.

Compulsory:

- You contribute 5 percent

- U-M contributes 10 percent, listed as two separate 5 percent contributions

Voluntary:

Voluntary contributions stop accumulating after a person becomes compulsory during the course of the year, but YTD will still appear on the paycheck.

- No individual contribution

- No U-M contribution

Compulsory and Enrolled

After a transition to compulsory participation, a voluntary participant’s paycheck will show only the compulsory rows.

- You contribute 5 percent

- U-M contributes 10 percent – a two-for-one match – shown as two separate 5 percent contributions

Compulsory and Not Enrolled: Reduced Benefit Option

If you are not enrolled in the Basic Plan when you meet the compulsory criteria, you will be enrolled in the Reduced Benefit Option (RBO). In this case, you will not have a before-tax deduction from your pay, and you will receive a 5 percent contribution under Employer Paid Benefits on your paycheck, and not the two-for-one match.

- You contribute nothing

- U-M contributes 5 percent

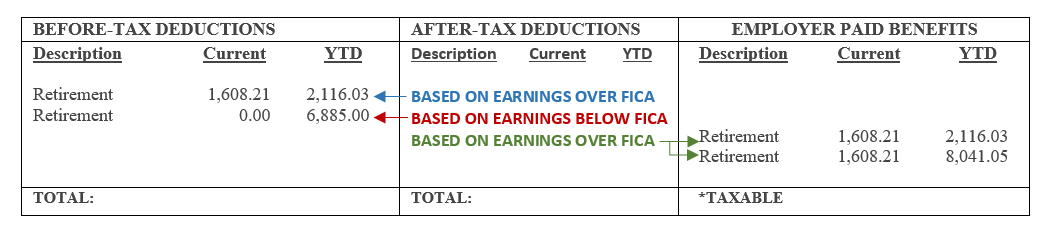

How FICA Impacts Your Retirement Savings

FICA is an acronym for the Federal Insurance Contributions Act. It is a federal tax paid by employees and employers to fund Social Security and Medicare. There is no maximum limit on wages for Medicare tax. Social Security taxes are limited to a wage base set annually by the IRS. The examples above are for individuals with earnings below FICA annually. If your earnings are above FICA, your payroll deductions and the university contributions toward your Basic Retirement Savings Plan will differ as shown in the following examples. The Social Security taxable wage base for 2022 is $147,000.

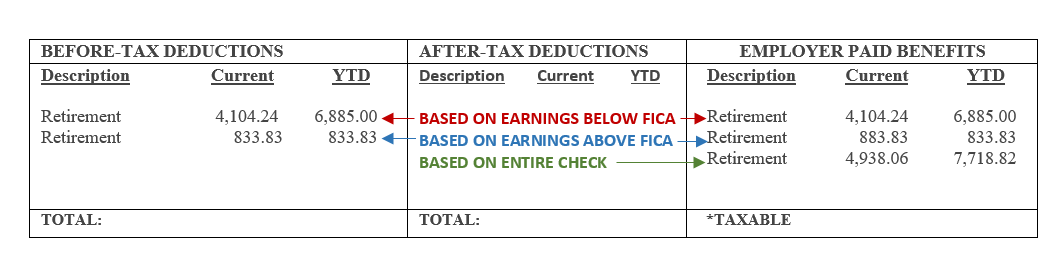

Compulsory: Transition Over the FICA Wage Base

If you are a compulsory participant in the Basic Retirement Savings Plan and your earnings cross the FICA wage base, your paycheck will display contributions based on your earnings below FICA and contributions based on your earnings over FICA.

Earnings below FICA:

- You contribute 5 percent 403(b) on earnings below FICA

- University contributes 5 percent 401(a) on earnings below FICA

Earnings over FICA:

- You contribute 5 percent 401(a) on earnings over FICA

- University contributes 5 percent 401(a) on earnings over FICA

- University contributes 5 percent 401(a) RBO on the entire check

Compulsory: Over the FICA Wage Base

If you are a compulsory participant in the Basic Retirement Savings Plan and your earnings are over FICA:

- You contribute 5 percent on earnings over FICA.

- No current contributions on earnings below FICA. Earnings for the year exceeded FICA by the time this example paycheck was cut. The year-to-date (YTD) total is the total 403(b) amount that has been deducted up to FICA (5% x FICA). For 2022, FICA is $147,000 (5% x $147,000 = $7,350).

- University contributes 10 percent 401(a) on earnings over FICA:

- 5 percent match

- 5 percent RBO